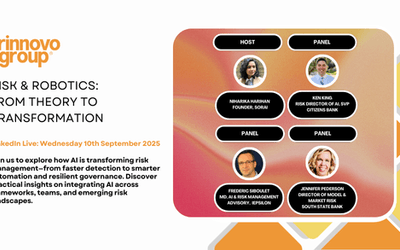

Join us on LinkedIn Live, Wednesday 10th September, for our Risk & Robotics: From Theory to Transformation webinar.

With our expert panel, we'll be exploring how AI is transforming risk management—from faster detection to smarter automation and resilient governance. Discover practical insights on integrating AI across frameworks, teams, and emerging risk landscapes.

This event explores the transformative impact of artificial intelligence on risk management across six critical dimensions. Attendees will gain insights into how AI is accelerating risk identification and monitoring, with early-warning systems and anomaly detection uncovering threats in real-time—while also confronting the blind spots and limitations of current models. We’ll examine progress in embedding AI into risk frameworks, including integration across the three lines of defence and balancing AI insights with traditional taxonomies, governance, and ethics.

The session will also spotlight operational risk automation, highlighting successful use cases such as automated RCSAs, KRIs, and incident logging. As AI tools evolve, adapting risk culture and capabilities becomes essential—requiring shifts in talent strategy, digital fluency, and reskilling for effective human-AI collaboration.

We’ll address the complexities of model risk and explainability, including validation standards, regulatory expectations, and what constitutes acceptable transparency. Finally, the agenda covers how technology is advancing the tracking of geopolitical, ESG, and regulatory risks, navigating fragmented global regulations and external volatility.

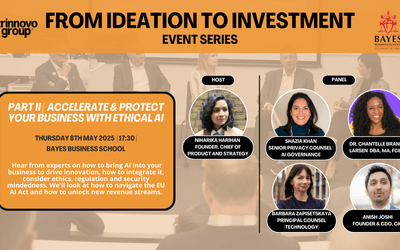

We have an excellent host and fantastic panel, find out more about them below:

Speaker Profiles

Host: Niharika Hariharan

Niharika is a partner and leads strategy and product at Sorai, a studio that specialises in bringing the rigour of business consulting, customer experience and AI to launch new products, ventures and strategies. At Sorai, Niharika helps banking and tech clients, design and launch new digital products, scale high-performing teams, and develop data and AI strategies.

With 18 years of experience in launching products including AI applications, she has worked both in Asia and Europe advising Fortune 500 clients such as Nokia, Barclays, Vodafone, NedBank, Nationwide on strategy, customer experience, and digital transformation. Prior to Sorai, she was an Associate Partner at McKinsey&Co Limited (UK), leading in their Financial services and Consumer practice. Niharika has been a visiting guest tutor and an advisory board member for the Business Design Studio at Imperial College Business School. She has authored publications on AI and Design and speaks globally at leading conferences.

Ken King, Citizens Bank

Ken’s background entails nearly 20 years in financial services, starting as a financial analyst at a consulting firm specializing in ALCO for community banks before transitioning to Citizens where he spent 10 years within model risk management. He worked to become a certified FRM and served as the Head of Model Governance the last 3 years there. More recently taking a newly created AI-centric role within first line risk overseeing the generative AI governance program for the enterprise.

Jennifer Pederson, South State Bank

Jennifer has worked in banking for the last 20 years and is currently the Director of Model and Market Risk at South State Bank. She has been in this role for the last six years and oversees the model validation team as well as model governance for the bank. She leads the bank’s Model Risk Management Committee and is a part of the Bank’s AI Committee where she is working on setting up AI governance for the bank. Prior to her role at South State, she held leadership and senior technical analyst positions in Credit Loss Forecasting, Secondary Marketing, and Finance at State Farm. She was a co-leader on the ABA Women in Model Risk Management two years and is currently a co-leader of the Leading Practices WMRMD Group.

Frederic Siboulet

Managing Director, Artificial Intelligence and Risk Management Advisory, iEpsilon,

Frederic has a track record of successfully directing business and technology projects in Wall Street, with cross-asset expertise in banking, trading, investment management, operations, and risk management. In the last ten years, he has been focused on valuation, data and analytics, artificial intelligence, and blockchain technology.

Over the last 25 years, he has had leadership roles with Deloitte, Ernst & Young, Reuters, IBM, Murex and Algorithmics, delivering mostly in large financial institutions such as JP Morgan and Citibank. Frederic has a passion for continuous learning and for teaching derivatives valuation, risk management, blockchain, and cryptocurrency at NYU, in the Master of Finance and Risk Engineering program.